Permanent mortgage calculator

Contractors typically earn considerably more than employees as you can charge clients higher rates for temporary access to your skills. Construction-to-permanent loans are also easier to qualify for than stand-alone construction loans.

Loan Amortization Schedule Calculator Home Mortgage Calculator College Loan Calculator Car Loan Calculator Pay Off Mortgage Pay Off Loan

This calculator helps you determine what annual salary you should target as a permanent employee in order to match your net contracting income.

. In the US the Federal government created several programs or government sponsored. The prepayment is applied directly to the principal of your mortgage. If you choose a closed mortgage you may prepay up to 10 of the original principal amount of your mortgage once in every 12-month period.

New Business Rates - Green Fixed 4 year. Online since 1999 we publish thousands of articles guides analysis and expert commentary together with our. For now if you cannot take more permanent action pay a little extra principal when you can.

Contractor Calculator the UKs authority on contracting serves a readership of over 200000 visitors per month see latest traffic report made up of contractors from IT telecoms engineering oil gas energy and other sectors. It funds the land and the construction and then the loan converts into a permanent mortgage once the construction is complete. You can avoid potentially higher interest rates saving you money in the long term.

You can apply to add on up to your original mortgage amount with minimal costs. 2 min read. Six ways to pay off your mortgage early.

Offset savings example calculation. Lets say you are 3 years into a 30-year 500000 home loan with a 100 offset account which you havent yet added any savings toYou have built up some money. If you were to borrow the additional 64000 with the add-on option your existing mortgage rate would be blended with the current rate for a 3-year term mortgage and your monthly payments would be adjusted to reflect the new amounts of principal and interest.

Even an extra 10 a month can make a difference in the long run especially with a new 30-year mortgage. How to work with a broker to get a better home loan deal. By securing a construction loan and permanent mortgage at once youre also avoiding any changes in the market during or after construction.

Australian Unity home loans health insurance life insurance. Permanent alimony is an agreement made for an indefinite amount of time. Newcastle Permanent credit cards home loans insurance products.

The payments made during the build are interest-only and then you settle your balance as you roll the principal into your 30-year fixed-rate mortgage. Using a mortgage broker. This saved interest amount reduces the principal outstanding of your loan on a permanent basis thus effectively shrinking the tenure of your loan and closing it much faster.

Pay off your mortgage faster. This loan can be more. Work out if youll save money by switching to another mortgage.

Typically the term or length of a commercial mortgage can be anywhere from 1-10 years with limited exceptions for longer terms on self-amortizing loans such as SBA loans up to 25 years insurance or Fannie Mae loans up to 30 years or FHA loans up to 35 years for refinance or 40 years for construction to permanent financing. 4 Year Fixed Rate New Business - LTV less than or equal to 60. A legal document that pledges property to the mortgage company as security for the repayment of the loan.

The mortgage calculator assumes a premium of 050 for the Home Credit - Fast Track loan over the rate of. The purpose of durational alimony is to give financial support to a spouse for a finite amount of time. This loan type will usually.

We chose BuildBuyRefi as our best overall construction loan lender because it lends in 47 states offers loans with low down payments and low interest rates and can finance the land the construction and a permanent. Compare the cost of switching your mortgage. Your monthly mortgage repayment must be made from a permanent tsb Explore Account and meet qualifying criteria.

Try the mortgage calculator to find out how much you can expect to pay on a 15-year mortgage compared to a current 30-year mortgage. Quickly see how much interest you will pay and your principal balances. There are cases where buying permanent life insurance makes sense such as funding for someone who will always be financially dependent.

A great way to save on interest costs and reduce the life of your mortgage is by making annual principal payments. Whats more this money can be withdrawn whenever you want. Only mortgage payments made by Direct Debit or Internal Standing Order from an Explore Account will get the 2 cashback monthly.

2 cashback monthly will be paid until 31122027. 15-Year Vs 30-Year Mortgage Calculator Mortgage. Mortgage Repayment Calculator Australia Use this calculator to generate an amortization schedule for your current mortgage.

The company has over 100 years of combined experience. BuildBuyRefi formerly Nationwide Home Loans Group is a division of Magnolia Bank. Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders.

A more common type of real estate loan this one will combine the two loans build mortgage into one 30-year loan at a fixed rate. A dwelling of at least 400 square feet and at least 12 feet wide constructed to the HUD Code for manufactured housing that is built on a permanent chassis installed on a permanent foundation system and titled as real estate. Construction-to-permanent or C2P loan.

It can be modified at any time based on substantial changes in either partys circumstances.

Ultimate Construction Loan Calculator Irregular Borrows

Free Interest Only Loan Calculator For Excel

Loan Calculators Rbc Royal Bank

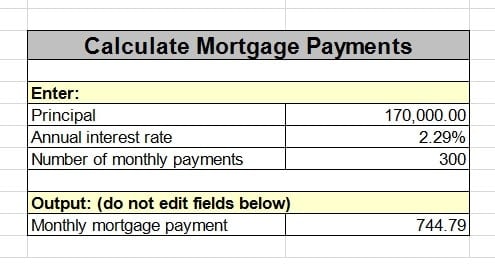

Free 8 Sample Mortgage Amortization Calculator Templates In Pdf

Mortgage With Extra Payments Calculator

Ultimate Construction Loan Calculator Irregular Borrows

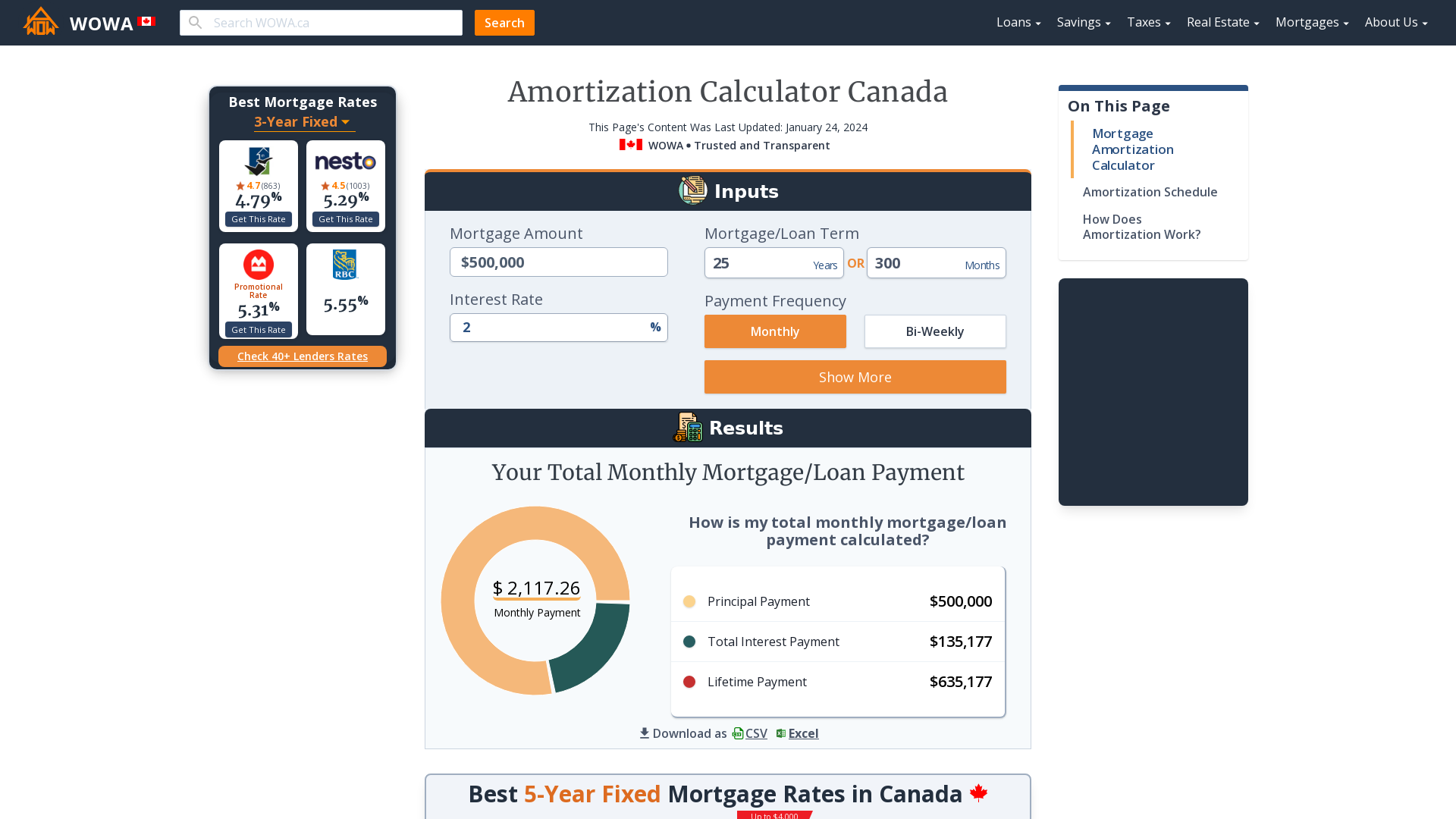

Mortgage Amortization Calculator Canada Wowa Ca

Ultimate Construction Loan Calculator Irregular Borrows

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Calculation What Is The Formula For Calculating The Mortgage Constant When Payments Are Made At The Beginning Of The Period Personal Finance Money Stack Exchange

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Excel Formula Estimate Mortgage Payment Exceljet

How To Calculate Mortgage Monthly Payment Using Excel With Formula Algorithms Blockchain And Cloud

How To Use A Rent Vs Buy Calculator Forbes Advisor

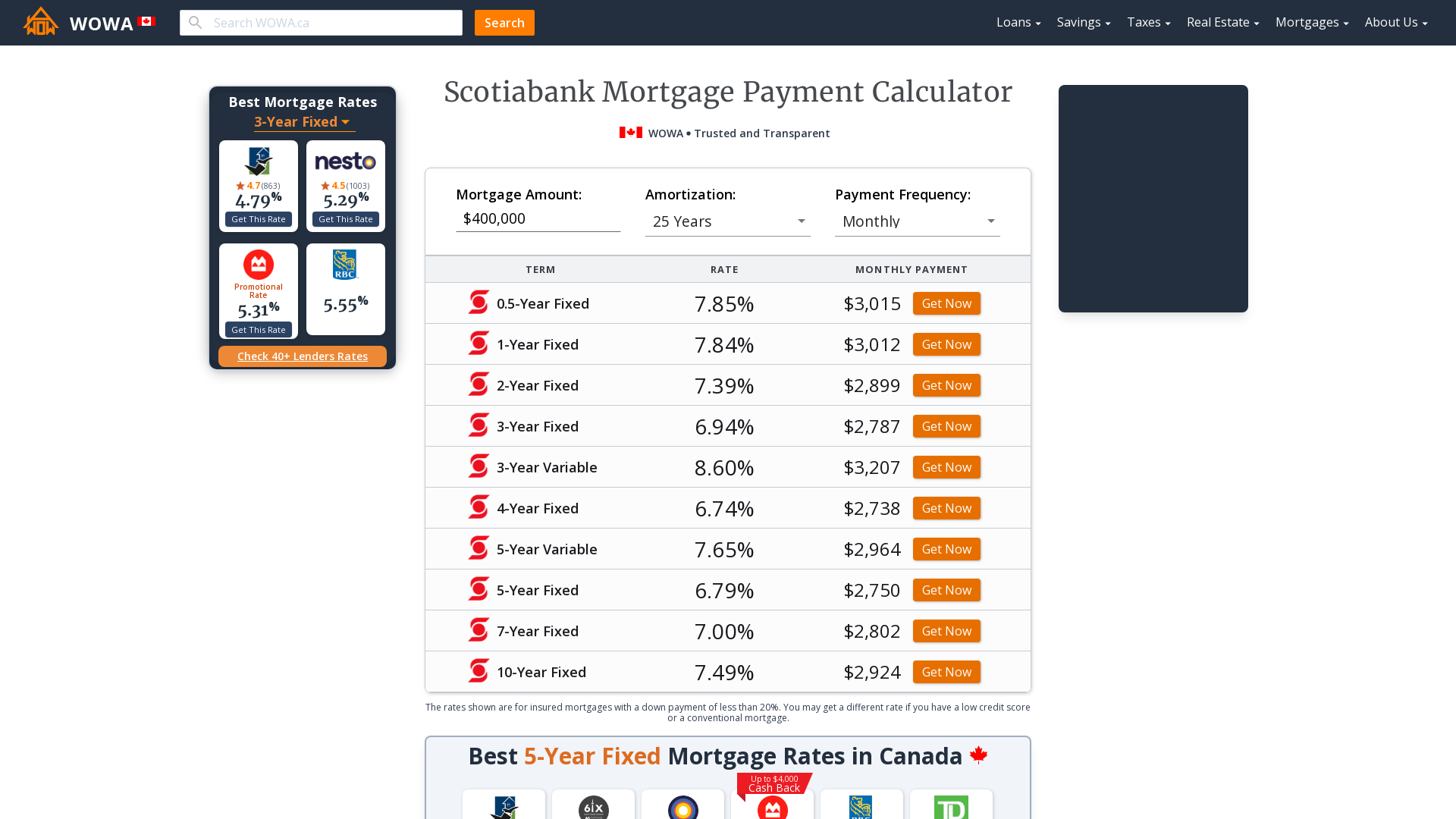

Scotiabank Mortgage Payment Calculator Aug 2022 Wowa Ca

The Simple Mortgage Calculator Implemented In C C Javascript And Mysql Algorithms Blockchain And Cloud

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow